Every business, from small shops to global corporations, deals with accounts payable almost every day. This might sound routine, but the numbers are striking. Accounts payable can make up over 50 percent of a company’s total liabilities. Most people think this is just about paying bills on time. The real twist? How well a company manages its accounts payable can actually decide its long-term survival and growth.

Understanding Accounts Payable Terminology for Businesses

Table of Contents

- Defining Accounts Payable: What It Is And Its Importance

- Key Terms In Accounts Payable: An Essential Vocabulary

- The Role Of Accounts Payable In Business Operations

- Common Processes In Accounts Payable And Their Impact

- Challenges In Accounts Payable: Understanding Financial Risks

Quick Summary

| Takeaway | Explanation |

|---|---|

| Accounts payable is a current liability | It reflects short-term obligations to suppliers, impacting cash flow on the balance sheet. |

| Timely payments build vendor relationships | Maintaining positive interactions with suppliers is crucial for operational efficiency and credit terms. |

| Implement strong internal controls | Robust mechanisms prevent financial fraud and ensure compliance, safeguarding the organization against losses. |

| Regular invoice verification is essential | Accurate invoice processing through matching and approval steps prevents payment errors and duplicates. |

| Understand key terminology for clarity | Familiarity with accounts payable vocabulary enhances financial communication and accurate record-keeping. |

Defining Accounts Payable: What It Is and Its Importance

Accounts payable represents a critical financial concept for businesses, serving as the backbone of financial tracking and cash flow management. At its core, accounts payable refers to the short-term monetary obligations a company owes to external vendors, suppliers, and creditors for goods and services purchased on credit.

The Fundamental Definition

In financial terminology, accounts payable is a current liability that appears on a company’s balance sheet. When a business receives goods or services without immediate payment, it creates an accounts payable entry. This process allows companies to maintain operational flexibility by purchasing necessary resources while deferring immediate cash expenditure.

Key characteristics of accounts payable include:

- Represents money owed to suppliers

- Short-term financial obligations

- Tracked as a current liability

- Critical for managing business cash flow

Strategic Financial Management

Effective accounts payable management goes beyond simple record keeping. According to Investopedia, proper handling of accounts payable impacts a company’s financial health, credit rating, and supplier relationships. Businesses must balance timely payments with maintaining sufficient working capital.

The strategic importance of accounts payable involves several critical aspects:

- Maintaining positive vendor relationships

- Optimizing cash flow management

- Avoiding late payment penalties

- Establishing financial credibility

By understanding and managing accounts payable effectively, businesses can create a robust financial framework that supports sustainable growth and operational efficiency. Learn more about advanced invoice processing techniques to enhance your financial workflows and streamline accounts payable management.

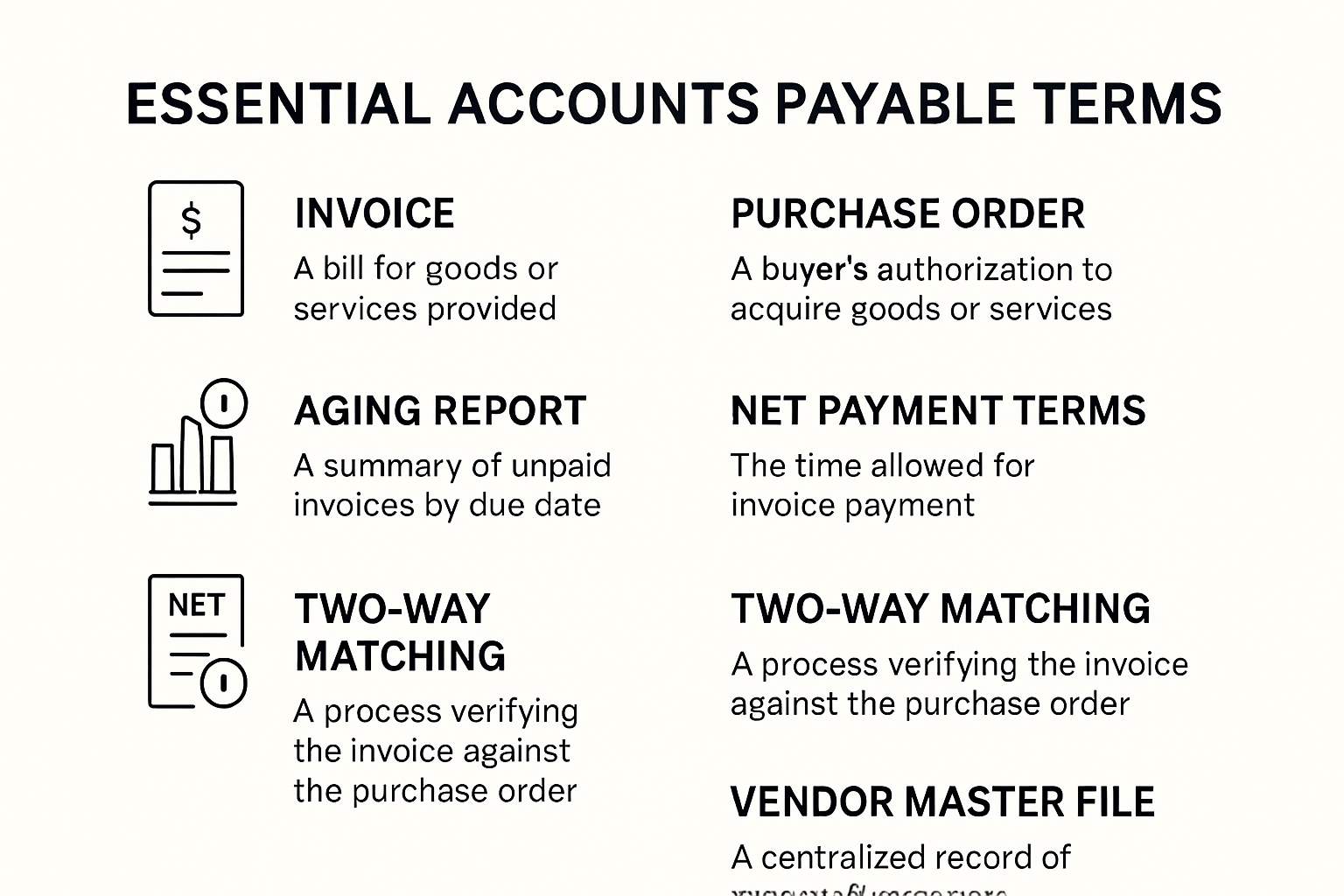

Key Terms in Accounts Payable: An Essential Vocabulary

Navigating the world of accounts payable requires understanding a specialized financial language. Professionals must become familiar with specific terminology that defines how businesses track, manage, and process financial obligations to vendors and suppliers.

Core Accounts Payable Vocabulary

Understanding key terms provides clarity and precision in financial communication. These foundational concepts help accounting professionals communicate effectively and maintain accurate financial records.

Essential accounts payable terms include:

- Invoice: A billing document detailing goods or services provided, including total amount owed

- Net Payment Terms: Specified timeframe for completing payment after invoice receipt

- Credit Period: Duration within which a company can defer payment without penalties

- Purchase Order: Official document authorizing a purchase from a vendor

Advanced Financial Terminology

As businesses grow more complex, accounts payable vocabulary becomes more nuanced. According to APQC, advanced professionals must understand intricate financial concepts that go beyond basic definitions.

Complex accounts payable terminology encompasses:

- Aging Report: Document tracking outstanding invoices by payment due dates

- Two Way Matching: Process of comparing purchase orders with invoices

- Vendor Master File: Comprehensive database of supplier contact and payment information

- Early Payment Discount: Financial incentive for settling invoices before scheduled due date

Explore detailed vendor invoice processes to deepen your understanding of these critical financial terms. Mastering this vocabulary empowers businesses to communicate precisely, manage financial obligations effectively, and maintain transparent vendor relationships.

To help you quickly understand essential accounts payable terms, here is a table summarizing each core concept and its definition:

| Term | Definition |

|---|---|

| Invoice | Billing document detailing goods or services provided, including the total amount owed |

| Net Payment Terms | Specified timeframe for completing payment after invoice receipt |

| Credit Period | Duration a company can defer payment without penalties |

| Purchase Order | Official document authorizing a purchase from a vendor |

| Aging Report | Document tracking outstanding invoices by payment due dates |

| Two Way Matching | Process of comparing purchase orders with invoices |

| Vendor Master File | Comprehensive database of supplier contact and payment information |

| Early Payment Discount | Financial incentive for settling invoices before the scheduled due date |

The Role of Accounts Payable in Business Operations

Accounts payable represents far more than a simple bookkeeping function. It is a critical financial process that impacts a company’s operational efficiency, financial health, and strategic decision making. Understanding its comprehensive role helps businesses optimize their financial workflows and maintain robust vendor relationships.

Strategic Financial Management

The accounts payable department serves as a strategic financial control center. By meticulously tracking and managing financial obligations, these professionals ensure that businesses maintain accurate financial records, control spending, and optimize cash flow.

Key strategic responsibilities include:

- Verifying and processing vendor invoices

- Monitoring payment schedules and terms

- Maintaining accurate financial documentation

- Preventing duplicate or incorrect payments

Operational Compliance and Risk Management

According to the University of Tennessee’s Business Management Guide, accounts payable plays a crucial role in organizational risk management. The function ensures financial transactions adhere to internal policies, external regulations, and maintain the highest standards of financial integrity.

Critical risk management aspects involve:

- Implementing robust internal control mechanisms

- Ensuring regulatory compliance

- Detecting and preventing potential financial fraud

- Maintaining transparent financial documentation

Discover advanced invoice approval workflows that can transform your accounts payable processes. By integrating sophisticated tracking and verification systems, businesses can turn accounts payable from a routine administrative task into a strategic financial management tool that drives operational excellence and financial transparency.

Common Processes in Accounts Payable and Their Impact

Accounts payable processes form the backbone of financial management for businesses. These systematic workflows ensure accurate financial tracking, timely payments, and maintaining healthy vendor relationships. Understanding these processes helps organizations optimize their financial operations and minimize potential risks.

Invoice Processing and Verification

The invoice processing workflow represents a critical accounts payable function. This complex procedure involves multiple steps to validate, record, and approve financial transactions. Businesses must develop robust mechanisms to ensure each invoice receives thorough scrutiny before payment.

Key invoice processing steps include:

- Receiving and logging incoming invoices

- Matching invoices with purchase orders

- Verifying vendor details and billing accuracy

- Routing invoices for appropriate internal approvals

Internal Control and Compliance Mechanisms

According to the University of California, Davis, implementing strong internal controls is essential in accounts payable. These mechanisms protect businesses from financial errors, potential fraud, and ensure compliance with regulatory standards.

Critical compliance aspects involve:

- Segregation of financial duties

- Establishing clear approval hierarchies

- Maintaining comprehensive audit trails

- Creating systematic review processes

Explore advanced invoice processing techniques to enhance your financial workflows. By implementing sophisticated verification and tracking systems, businesses can transform accounts payable from a routine administrative task into a strategic financial management tool that promotes operational efficiency and financial transparency.

Challenges in Accounts Payable: Understanding Financial Risks

Accounts payable processes are vulnerable to numerous financial risks that can significantly impact an organization’s fiscal health. Understanding these potential challenges helps businesses develop proactive strategies to mitigate potential financial vulnerabilities and protect their economic interests.

Fraud and Error Prevention

Financial vulnerabilities in accounts payable often stem from inadequate internal controls and systemic weaknesses. Businesses must recognize and address potential risks before they escalate into substantial financial losses. Fraudulent activities and human errors can create substantial economic disruptions if left unchecked.

Primary fraud and error risks include:

- Duplicate invoice payments

- Unauthorized vendor modifications

- Artificial invoice inflation

- Manual processing mistakes

- Inadequate verification procedures

Compliance and Regulatory Challenges

According to the Washington State Auditor’s Office, accounts payable processes are increasingly susceptible to both internal and external threats. Organizations must develop robust compliance mechanisms to protect against potential financial misconduct and regulatory violations.

Critical compliance challenges involve:

- Maintaining accurate financial documentation

- Adhering to changing regulatory requirements

- Implementing comprehensive audit trails

- Preventing potential tax and reporting violations

Learn about advanced invoice audit techniques to enhance your financial risk management. By integrating sophisticated verification systems and maintaining rigorous internal controls, businesses can transform potential vulnerabilities into opportunities for financial optimization and strategic risk management.

Unlock Faster, Smarter Accounts Payable with Automated Data Extraction

Understanding the ins and outs of accounts payable terminology is a powerful step, but manually processing invoices can slow you down and cause costly mistakes. If you worry about duplicate payments, managing invoice data by hand, or struggling to catch every detail like net payment terms or aging reports, you are not alone. Many businesses face the same challenges, and falling behind in accounts payable management can impact your vendor relationships and cash flow.

It is time to streamline your entire process. With Invoice Parse, you can use advanced AI to automatically extract important fields from your invoices. Upload any PDF or image file and instantly see structured data for vendor names, totals, and line items with no templates or setup needed. Easily connect your data to Excel, Power BI, or your favorite workflow tool for painless integration. Take control of your accounts payable vocabulary in practice, prevent manual errors, and gain faster insights to support your team’s success. Get started today and see how Invoice Parse can turn your new understanding into real financial agility.

Frequently Asked Questions

What is the definition of accounts payable in financial terms?

Accounts payable refers to the short-term monetary obligations a business owes to its suppliers or vendors for goods and services received on credit. It is classified as a current liability on the balance sheet.

How does accounts payable impact cash flow management for businesses?

Effective accounts payable management allows businesses to strategically manage cash flow by controlling the timing of payments, optimizing working capital, and maintaining positive vendor relationships.

What are some common terms associated with accounts payable that businesses should understand?

Key terms include ‘invoice’ (billing document detailing owed amounts), ‘net payment terms’ (timeframe for payment after receiving an invoice), and ‘purchase order’ (document authorizing a purchase).

What are typical challenges faced in accounts payable processes?

Common challenges include fraud prevention, errors in invoice processing, compliance with regulatory requirements, and maintaining accurate financial documentation.

Recommended

- AI Invoice Parse – Vendor Invoice Guide: Everything You Need to Know in 2025

- AI Invoice Parse – The Ultimate Guide to Invoice From Vendor for Beginners (2025)

- AI Invoice Parse – Invoice and Billing Versus: Key Differences Explained 2025

- AI Invoice Parse – Invoice Approval Workflow: Steps, Best Practices, and Tools

- Basic Accounting Principles for South African Businesses 2025 - Ready Accounting